Now that the U.S. Senate is expected to have a Democratic majority, one provision absent from the most recent stimulus measure will likely regain attention: direct aid to state and local governments. While most states are still facing general fund revenue shortfalls, state budgets are faring better overall than the apocalyptic forecasts over the summer months.

States are Beating Pessimistic Forecasts

State budgets are outperforming expectations primarily for three reasons:

- Higher-than-expected revenues: States have been beating revenue forecasts over the last five months. This has been driven by shifting revenue from fiscal year 2020 into FY 2021, state taxes on some of the federal aid given to individuals (like enhanced unemployment benefits), and an unexpectedly sharp economic rebound.

- State government cuts and adjustments: States made average reductions of about 10% to their general fund expenditures during their initial response to the fiscal crisis, although some of those cuts might be reversed based on the improved financial outlook. These adjustments could serve as an opportunity for the private sector, as government agencies are forced to do more with less and thus find themselves more incentivized to outsource some of the services previously provided by government employees.

- Federal aid: An increased FMAP rate of 6.2% and targeted appropriations by federal legislation have taken care of a large portion of new expenditures states incurred due to COVID-19. Additional flexibility for federal CARES Act funds awarded to states has allowed states to theoretically “backfill” some of the revenue lost as a result of the pandemic. The latest federal Appropriations Act granted the states even more flexibility, extending the states' deadline to expand CARES funds by an extra year.

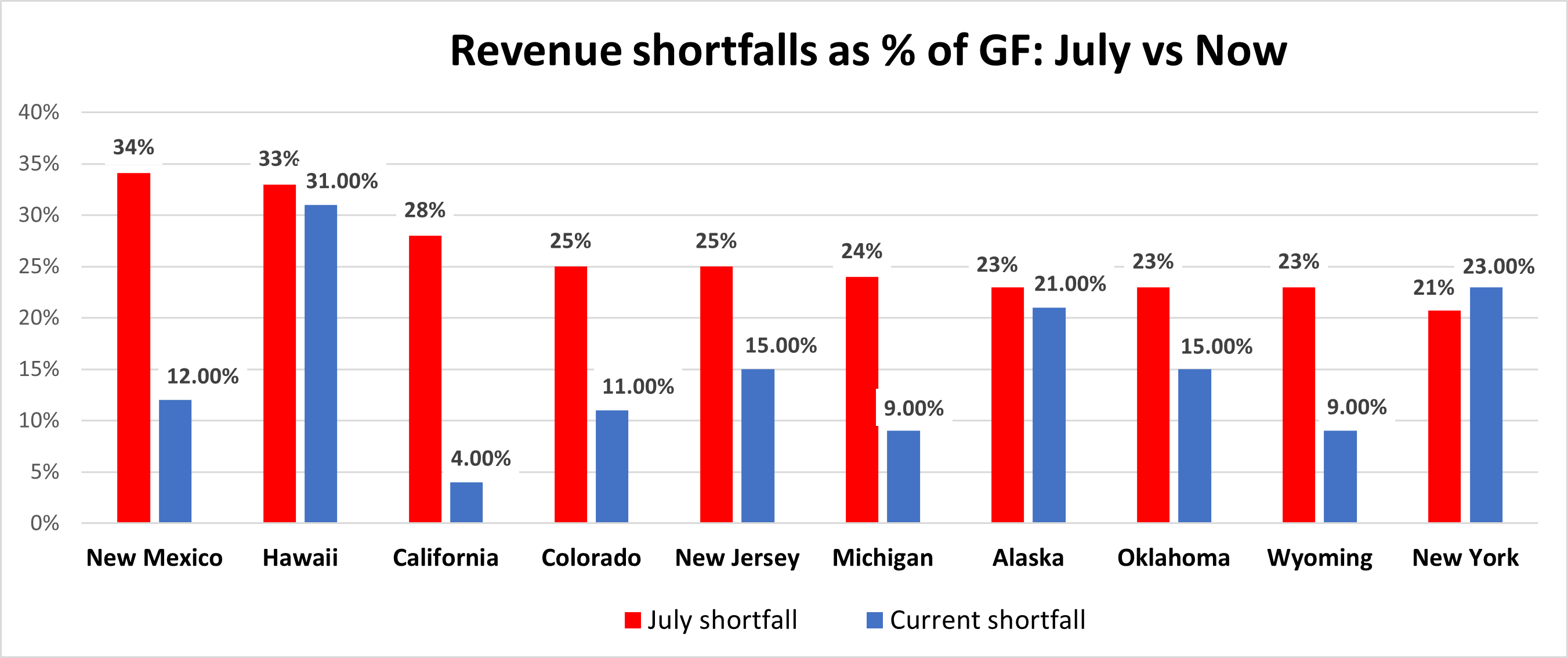

Based on the most recent reports, state budgets across the country are now forecast to lose an average of 10% of their general fund revenue in the combined 2020 and 2021 fiscal years. Although this is not an insignificant amount – especially considering that most states grow their revenue from year to year — the current outlook is much better than the summer forecasts, which expected state governments to lose almost 18% of their general funds on average. A clear example of this can be seen when reviewing a sample of the states with the largest reported revenue shortfalls in the summer. These ten states have seen an average 10% reduction in their shortfalls as of the most recent data released through November.

One of the biggest surprises so far has been California, which was initially forecast to suffer the most significant dollar-amount-combined deficit of $54 billion by the end of the fiscal year but is now expected to close fiscal years 2021 and 2022 with $12 billion and $6 billion respectively. In addition to the reasons stated above, California’s rebound was also powered by a rainy-day fund withdrawal of about $8 billion and a stock market rally that largely benefited Silicon Valley’s technology community. Like Idaho, Nebraska, North Dakota, Oregon, and South Dakota, other states have brought in even more revenue than they had expected to collect before the pandemic, driven partly by economic activity shifting away from big cities and highly-taxed states.

Problems persist past FY 2021

On the other hand, states like Hawaii, Illinois, Nevada and New York still face historic revenue shortfalls that will outlive the current fiscal year and shape the political landscape for years to come. Since state budgets have seen a good amount of one-time revenues and savings in fiscal year 2021, due to federal aid and shifted revenue from fiscal year 2020, budget problems will likely persist for FY 2022 and beyond. This is the case even for states that are now expecting to close fiscal year 2021 with a surplus. Examples include Colorado, which is finishing fiscal year 2021 with a $1.2 billion surplus but is expecting an undisclosed deficit by end of fiscal biennium 2021-2023, Oregon, which is finishing FY 2021 with a $243 million surplus but needs to close a $792 million deficit for the new biennium, and Minnesota, which is expected to finish this fiscal biennium with a $394 million surplus but is forecasting an $883 million deficit for the new biennium.

In the coming weeks, we will find out how Governors across the country are proposing to adjust to this new fiscal reality, which is likely to spark feuds between the Executive and Legislative branches of state governments during session.

More States Legalize Marijuana, Expand Gaming, Increase taxes

Many have turned to new tax revenue opportunities as states try to avoid making cuts to government services or employees. Most recently, Governors Cuomo (D-NY), and Ned Lamont (D-CT), mentioned their interest to legalize sports betting and marijuana as more governors continue to see these markets as potential revenue sources for their budgets. Voters already approved at least 11 new taxes or tax increases in the November general elections, many of which took on a new urgency due to pandemic-related belt-tightening. Some taxes have opened new markets—like marijuana and gaming—while others targeted popular products like tobacco and vaping devices.

Arizona, New Jersey, Montana, and South Dakota all legalized recreational marijuana use, with excise tax rates ranging from 15 to 20 percent. Oregon increased taxes on cigars and cigarettes, and Colorado enacted a tax on nicotine liquids and e-cigarettes. Maryland, Louisiana, and South Dakota voters approved measures to legalize sports betting, bringing the total number of states blessing wagers on games to 25. Nebraska did the same with racetrack gambling, imposing a 20% gross receipts tax. Other tax increases include Colorado’s payroll tax to finance paid family and medical leave insurance benefits, Arizona’s income tax increase, and several states’ property tax changes. Expect other similar ballot measures in 2021 and 2022 as states explore options to expand their revenue base and adjust their tax codes to make their post-pandemic comebacks.

Whether Congress will send additional federal aid to states in 2021 is still unknown, but two things seem inevitable: First, state budgets are looking better than the apocalyptic predictions of the summer; and second, debates about budget cuts and revenue generation will dominate the 2021 legislative sessions, which are just getting started.

Edgar Velasco leads Stateside's monitoring and analysis of the many facets that make up state budget policy. Edgar has experience interning for the New York State Assembly, NASA, and MetLife, and has worked as a Legislative Assistant in the Puerto Rico State Senate for Majority Leader Carmelo Rios. Edgar passed the Chartered Financial Analyst (CFA) level 1 exam and has a passion for finance and fiscal issues, particularly as they intersect with public policy. Complete bio here.