By: Edgar Velasco Senior Associate, State Budgets

Over the last three months, state governments have implemented Stay at Home Orders and business closures in an effort to slow the spread of coronavirus infections in our nation, while inflicting a serious blow to their state economies and revenues. With state income and sales taxes being the primary source of revenue for so many states and the massive job and business revenue losses accompanying the shut-downs, future state budgets will suffer like never before.

Many states enacted their biennial budgets in 2019. As the majority of state budget recommendations or adjustments for FY 2021 are based on revenue forecasts compiled from December through February, states have been forced to dramatically revise their revenue projections and adjust their budgets accordingly.

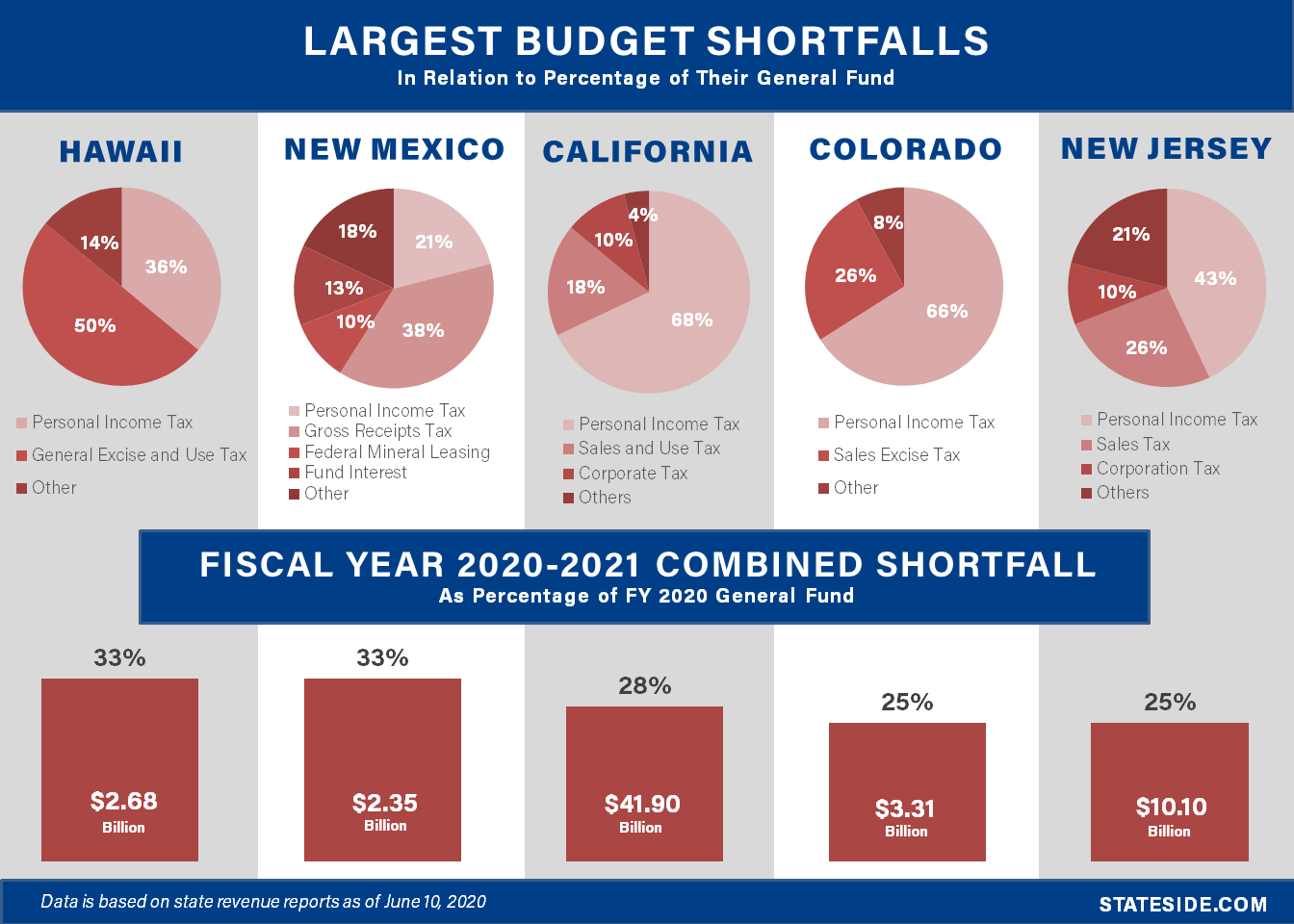

From the states that have already published their updated revenue forecasts, shortfalls represent about 18% of their general fund budgets on average. The size of the shortfall should not come as a surprise since states’ individual income taxes (42%) and sales and use taxes (32%) make up more than 70% of states’ own revenues on average. These taxes are inarguably the two most affected areas of state budgets as the economy became paralyzed as a result of growing consumer panic and state-ordered quarantines. This fiscal crisis has led Governors across the nation to request $500 billion in additional federal aid to backfill some of the revenue loss, as an alternative to the brutal cuts most states will need to employ. Unlike the federal government, states have to balance their budgets each year, so if they don’t have a big enough rainy day fund, borrowing, cuts, or taxes are the only options. Having lost about one-fifth of their budgets, if no additional federal funds are made available either massive cuts or tax increases are imminent across our 50 states and DC.

Budget cuts are likely to have substantial adverse effects on areas such as healthcare and education, which comprise more than 60% of general fund expenditures on average. Whereas tax increases, as a way to obtain additional revenue, might be a double-edged sword for states that are looking to jumpstart their economies after the severe hit taken as a result of the pandemic. This is going to be the main policy discussion for states as they wrestle with this unprecedented challenge over the next few years.

We are already seeing this issue play out as proposals are introduced in some states to help close budget gaps. A good example is Colorado’s HB 1420, now awaiting action by the Governor, which expands taxable income, limits the amount of net operating loss a corporation can carry to another taxable year, and eliminates the state income tax modification for qualifying capital gains, as a way to offset some of the projected cuts to education. These decision points are certain to influence a great amount of policy considerations in state governments, as state governments will need to consider these through the prism of fiscal and economic effects these policies might have further along the road. As many state legislatures start coming back for special sessions, having an understanding of the state budgets landscape allows stakeholders to better understand, prioritize, and interact with state governments around the nation.

Stateside is actively monitoring the state fiscal effects of COVID-19. Are you wondering how the state budget landscape might change and the potential impacts to your organization? Stateside can help.

Edgar Velasco leads Stateside's monitoring and analysis of the many facets that make up state budget policy. Edgar has experience interning for the New York State Assembly, NASA, and MetLife, and has worked as a Legislative Assistant in the Puerto Rico State Senate for Majority Leader Carmelo Rios. Edgar passed the Chartered Financial Analyst (CFA) level 1 exam and has a passion for finance and fiscal issues, particularly as they intersect with public policy. Complete bio here.